Is the events industry (really) consolidating?

I had the pleasure of moderating the closing session of the UFI European Conference in Zurich at the beginning of the summer. With the help of expert speakers Christina Kehl, Julia Borispolets, and Phil Stone, we explored the topic of “Industry Consolidation And New Players.”

When I asked for a show of hands amongst the audience, there was a strong sense that our industry was beginning to consolidate much faster than before. A stat Phil Stone, Partner at Plural Strategy, shared brought this to life:

“...in 2012, the top 10 organisers represented around about 15-16% of the industry, and by the time you get to post-covid 10-11 years later, that's moved up to 29%, so compared to other industries like grocery supermarkets, that's still not very much, it's still very fragmented, but that's an incredible pace of change over ten years.”

According to Harvard Business Review, that puts our industry firmly at the beginning of the “Scale” stage of the consolidation curve. (I’ve calculated an adjusted 14% for the top three as per the study)

Industries in this phase focus on achieving scalability. Dominant players start to pull away from the peloton, acquiring competitors and establishing vast empires.

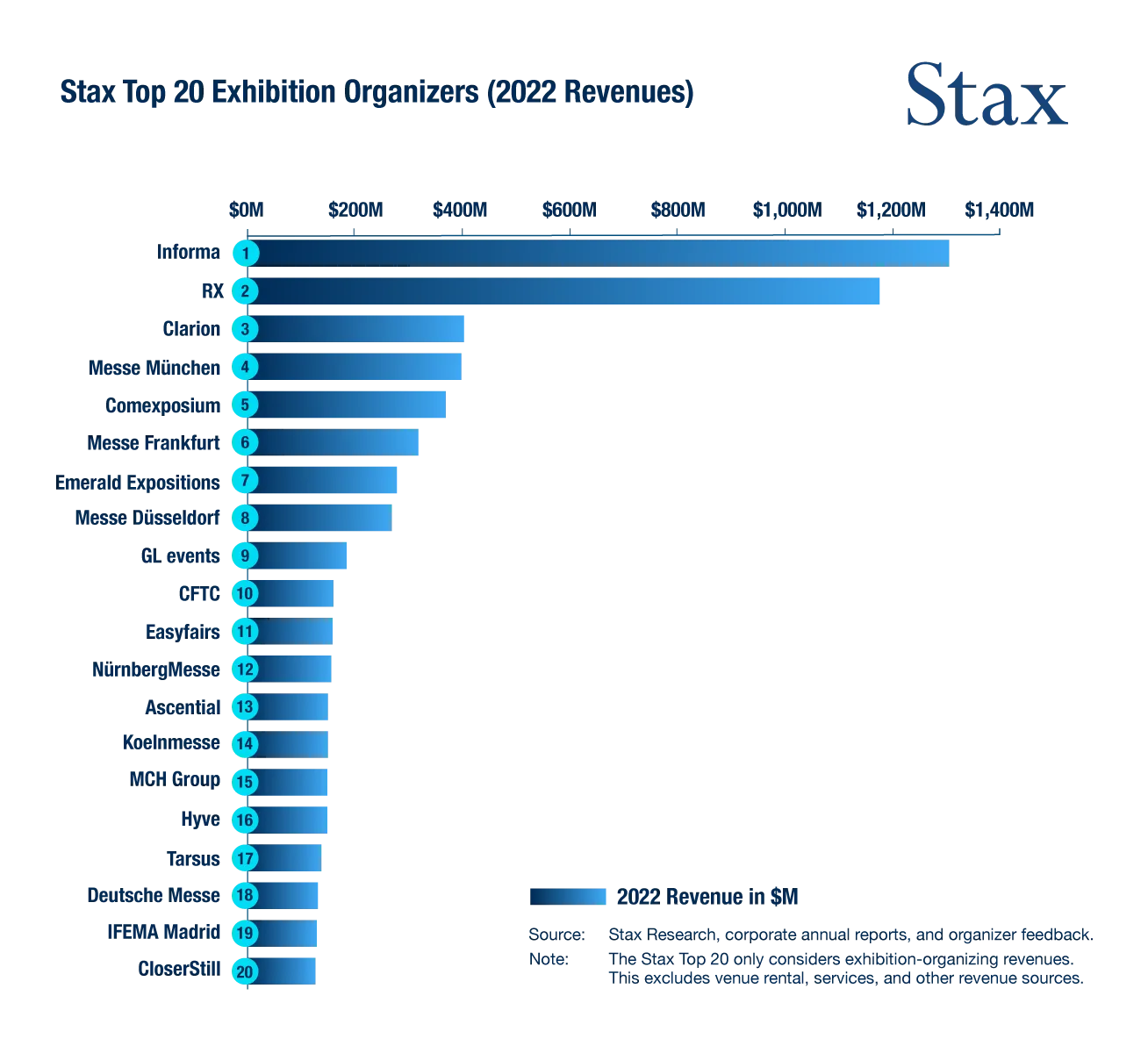

In our industry, this is clearly illustrated by the Stax top 20 list, which showcases two standout leaders and a third position that remains uncertain for the time being. If HBR is correct, we should see the top two starting to pull away faster and a third joining them while the rest begin to stagnate or even get acquired at some point.

Another thing to notice from studying the Top 20 retrospectively is that, curiously, not too many organisers have disappeared from the Top 20 in the past ten years. UBM, Tarsus, and, lately, Ascential have all been consolidated into the biggest player, Informa. Most of the action has been outside the top 20 for now. But that doesn’t mean it’ll be confined there.

While the scene might yet be set for further consolidation, Julia Borispolets, Corporate Development Director at RX Global, gave us some food for thought on future structural challenges. The biggest business events market in the World, The USA, is dominated by many association events, making it harder for professional organisers to scoop up market share quickly. Although there were significant acquisitions and partnerships with associations in the past, those tend to take considerable time. Similarly, with the venue organisers, especially in Germany, a path to quick consolidation seems highly unlikely.

This then begs the question: if the Messes are not potential targets, and the American market is structurally challenged, what businesses of scale are left out there that might move the needle for these big consolidators?

While there is no need to name names, we can agree that (not so many) PE investors currently own most of them. Another stat-drop from Phil better explains this:

“In 2012 only one of the top 20 organisers was owned by private equity; now it's six of the top 20“

He added the high level of interest indicates an imminent acceleration in consolidation within the industry. With the necessity to sell and the rapid, aggressive deployment of capital, there will likely be an increase in bolt-on M&A activities. Consequently, some of these entities will inevitably merge in due course.

That being said, there is already evidence of a single PE investor owning more than one organiser and not merging them, and another one owning an organiser and a venue and now launching another organiser! All this might change in so many different ways and so quickly. Exciting times (not too) ahead.

In such a landscape, it is clear that there is (again) an insatiable appetite for medium-scale businesses that have their house in order. Julia explains the key strategy for RX is having a really good playbook and acquiring more bread-and-butter events, but being able to add value through digital products, sales machines, and operational excellence.

I can attest to this from my own experience at corporate level organisers. Beyond the obvious (acquisition vs EV valuation) multiple arbitration play, value creation in acquisition cases is often propped up by an expectation that the acquirer's best practices, sales networks, and systems will create new value, and yes, some synergies on top for good measure. So, there’s a preconceived notion of where to add and extract value.

Similarly, on the Private Equity side, entrepreneurially strong teams are being backed, and they, in turn, back other entrepreneurial teams who apply their special sauce. Often, the PE investor already has the workings of their VCP (value creation plan) in hand, ready to challenge/motivate their management on day one. And you can rest assured it includes fast-tracking M&A as a key enabler.

Again, speaking from first-hand experience as a previous C-level exec at a PE-backed organiser and, lately, buy-side advisor on a large deal (that we lost), the acquirers have already convinced themselves of how they can add value to your business. It just has to be -unlocked-...

So, if you find yourself at the helm of such a business, I would double down on your fundamentals, get your business's basics right, and also build a streamlined tech stack that can play well with others. You can be sure your business’s value will be upgraded or downgraded based on the simplicity, interoperability, and robustness of your systems as much as anything else. You can use my self-assessment checklist to get a feel for where your business’s digital capabilities might be. Or, simply book a meeting with me, send me an email, or message me on WhatsApp, and we can chat about it.

Lastly, If you’re willing to be one of the big consolidators and are wondering what to do about all this, here’s what HBR thinks you should do:

“Because of the large number of acquisitions occurring in this stage, companies must hone their merger-integration skills. These include learning how to carefully protect their core culture as they absorb new companies and focusing on retaining the best employees of acquired companies. Building a scalable IT platform is also crucial to the rapid integration of acquired firms. Companies jockeying to reach stage 3 must be among the first players in the industry to capture their major competitors in the most important markets and should expand their global reach.”

So, even for the consolidators, it’s all about a streamlined digital backbone, supporting a no-nonsense business in growth!

A full recording of this session is available in your UFI Member Zone. If you’re not a member, contact Nick Dugdale-Moore to get involved.